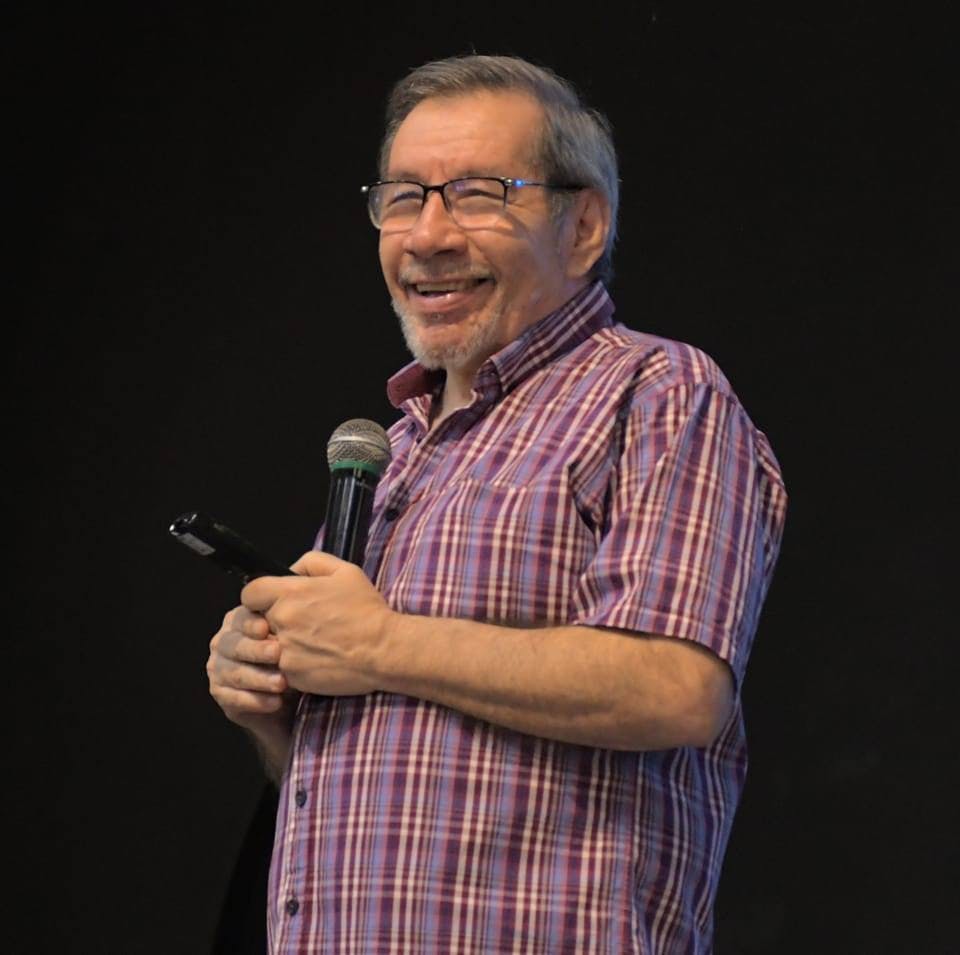

¡Bienvenido al sitio web de Raúl Justiniano!

Conferencista, mentor, coach, periodista, empresario, pastor principal de la Iglesia Renuevo para las Naciones y fundador de la Escuela de Coaching y Liderazgo Sal & Luz, con más de 30 años de carrera ayudando y sirviendo a la sociedad

Nuestros Programas Académicos y Cursos 2024

Estamos viviendo la era del conocimiento e información “Todos sabemos de todo”. Sin embargo, en nuestra vida práctica no ejecutamos los principios ni el conocimiento que aprendemos. Nuestro deseo es que con nuestros programas académicos y cursos puedas de manera práctica aprender principios de vida probados.

Algunos de nuestros libros y manuales inspiracionales

Ponemos a tu disposición nuestros libros y manuales inspiracionales que estamos seguros que serán de mucha bendición a para tu vida